Until October of last year, when the Provisional Measure of the Legal Taxpayer was issued, the only way for the taxpayer to obtain discounts on fines and interest on federal taxes was through special installment programs, known as Refis. As for the installment plan, there is an ordinary payment model up to 60 times, but without any discount by the Attorney General of the National Treasury.

MP 899/2019 was approved by Congress at the end of March and in April it was converted into 13.988 Law, known as the tax transaction law. It establishes permanent parameters for taxpayers to obtain discounts and installments to pay taxes that entered the Federal Active Debt category. The current stock of Federal Active Debt and FGTS is R $ 2,4 trillion, according to the most recent survey by the National Treasury Attorney General (PGFN). The value is within expectations, according to PGFN itself.

Discounts are up to 50% of the total amount, as long as it does not change the main amount, that is, the tax itself. The discharge period is up to 84 months. There are different rules for cooperative societies and Santas Casas de Misericórdia: with a reduction of up to 70% of the total amount and a term of up to 145 months. There is the possibility of total discount of fines, interest and legal charges, as long as the sum does not reach the established limits, of 50% and 70%, in relation to the amount.

“Law 13.988 brought an advantage for the taxpayer to negotiate his debts directly with the public entity, but the terms that are granted are short. So you will hardly have a businessman doing this, he will wait for a new Refis ”, says Luis Alexandre Oliveira Castelo, partner at Lopes & Castelo Advogados.

There are also complaints about the proposed discounts. "In my view, as the transaction discounts are not attractive, it is likely that we will have new bills for Refills, precisely to create greater benefits so that more people will join the program for the government to raise more money", evaluates Leonardo Andrade, partner in the tax area of Andrade Maia Advogados.

Andrade also criticizes the fact that the law does not deal with precatories: "Another criticism I make is that the law does not allow the debtor taxpayer to use his precatory as a bargaining chip in the transaction with the government."

On the other hand, there is a consensus on the importance of the new law to establish a greater dialogue between taxpayers and the Attorney General of the National Treasury. “In 20 years of career, I can count on my fingers the times I managed to talk to a prosecutor. We were unable to find a communication channel with the Prosecutor's Office ”, recalls Tatiana Chiaradia, partner at Candido Martins Advogados.

“The Attorney General's Office, more than a decade ago, has set out to avoid unnecessary litigation that costs money. And he has dedicated himself to these tools that put tax authorities and taxpayers side by side in a round table, with no edges ”, says João Grognet, general coordinator of Credit Recovery Strategy of the Attorney General of the National Treasury. "I don't want the image that we are at a table where the discussion has an unsteady balance to remain."

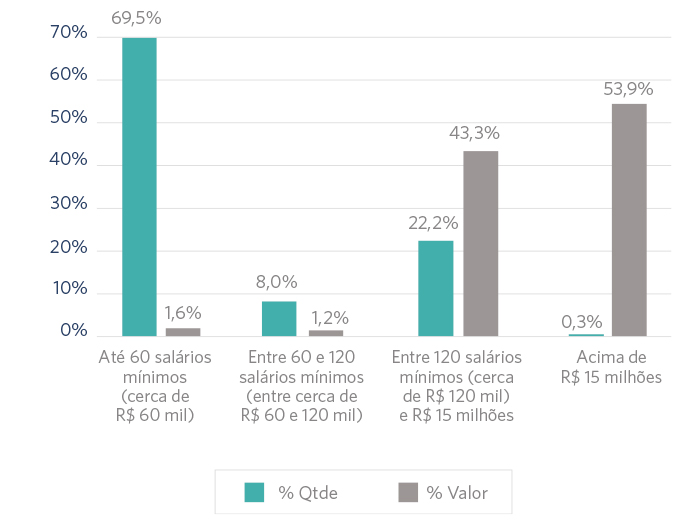

One of the main novelties brought by the tax transaction law is that taxpayers are distinguished when negotiating payment. The debt to be negotiated is divided into four categories: A, B, C and D. “I can only give a discount for irrecoverable credit. The general rule is that recoverability is measured based on the debtor's ability to pay, ”explains João Grognet. "The payment capacity is estimated based on a mathematical equation based on the presumptive signs of economic, financial and patrimonial activity".

These rules regarding the calculation of payment capacity are present in articles 19 and 20 of the 9917 / 2020 concierge of the PGFN. Article 19 says: “the economic situation of debtors registered in the Union's active debt will be measured based on the verification of registration, patrimonial or economic-fiscal information provided by the debtor or by third parties to the Attorney General of the National Treasury or to the other organs of the Public administration".

For Edson Vismona, executive president of the Brazilian Institute of Ethics in Competition (ETCO), there is a need for high transparency in the definition of this classification. "A suggestion that may provide greater legal certainty is the creation of a channel so that possible mistakes in the framework can be reported", he says.

Debts of up to R $ 15 million can only be paid in installments. In this case, the taxpayer must accept all the conditions imposed in the notice that proposes the installment plan. The notices published so far can be viewed here. If the debt amount is greater than R $ 15 million, it is possible to carry out the individual transaction, with direct negotiation with PGFN. To know the debt situation of each taxpayer, it is necessary to access the Federal Revenue website, more specifically the Taxpayer Assistance Center, the e-CAC.

"The limit that they established, of R $ 15 million, is quite high so that taxpayers can make individual recovery requests, which are more interesting, with payment and discount bases being negotiated in a more personalized way", evaluates Fernanda Lains , partner of Bueno e Castro. “When we talk about R $ 15 million, it is a low value for taxpayers in the South, Southeast, who have a higher revenue generation. When we go to the North and Northeast regions, it is difficult to reach that limit ”.

There is one caveat that generates criticism: the fact that the taxpayer who opts for the adhesion transaction has to give up administrative or judicial litigation related to the negotiated tax. “The Law makes it difficult to maintain a judicial measure for discussing a procedural issue in cases where the merit thesis is the subject of a proposed transaction, says ETCO's Edson Vismona.

Once the individual transaction is established, negotiation is made between the taxpayer and the Attorney General's Office of the National Treasury. “An individual transaction requires numerous meetings and discussions around the text of a transaction term. It may involve local inspection at the debtor's establishment. It is not something to happen in wholesale, it is in retail ”, explains João Grognet, from PGFN. “The prosecutors are open, wanting to resolve. Years ago I did not see this availability at the Farm ”, points out Maurício Maioli, head partner in the tax area of Feijó Lopes Advogados.

Until July, 204 thousand debts were transacted, from 55 thousand taxpayers, in the total amount of R $ 18,8 billion, according to the Attorney General of the National Treasury.

In June, the Ministry of Economy and PGFN published the 14.402 Ordinance, which establishes conditions for exceptional transactions because of the economic effects caused by the coronavirus. The membership period ends on December 29 and the transaction can be made on the portal regularize.

Low adhesion with taxpayers waiting for new Refills

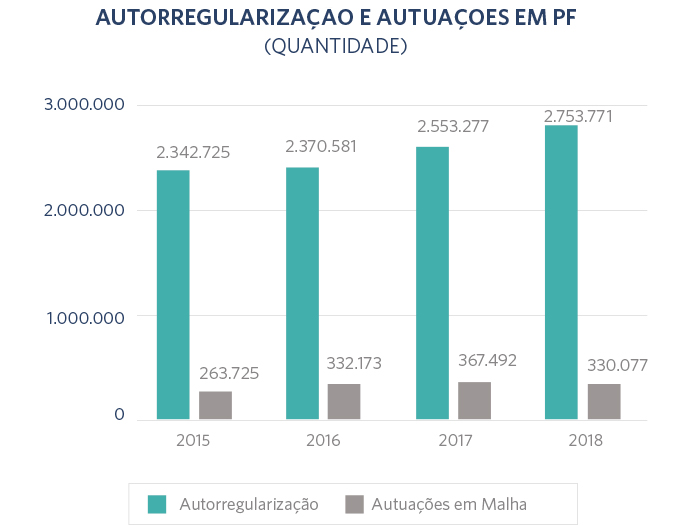

The first special installment program was created in 2000, with the establishment of the Tax Recovery Program (Refis). Since then, around 30 special installment programs have been designed, according to a survey by the Federal Revenue Service. There have been cases where taxpayers had access to a reduction of up to 100% in interest and fines.

Given this history, a large part of those who have tax debts with the Federal Government prefer to wait for a new installment program and, therefore, the demand for the tax transaction has been low. "Of my clients, few have joined because they are expecting to get bigger discounts with a new installment program", says Leonardo Andrade, partner in the tax area of the Andrade Maia office. “Many clients came to us to do a simulation, but no one did it,” says Luis Alexandre Oliveira Castelo, partner at Lopes & Castelo Advogados.

“In the short term, after this transaction law, I don't see any possibility of Refills. There is no political climate for a new Refis, ”says Mauro Silva, president of the National Association of Tax Auditors of the Federal Revenue of Brazil (Unafisco). In May, Congressman Ricardo Guidi (PSD-SC) presented the 2735 / 2020 Bill, which proposes a new installment program due to the state of public calamity motivated by the pandemic.

The proposal provides for discounts of up to 90% for late fees and official fines, late fees and legal charges, but there is no prospect of advancing the text in Congress.

There are also those who consider the terms allowed by the law of the transaction to be too short. “In the transaction law, the maximum term that the Treasury can grant is 84 months, and if it is a Simples company, up to 100 months. The old refills had terms of 15 and even 20 years ”, highlights Maurício Maioli, from Feijó Lopes Advogados.

In addition, the law resolves a portion of corporate tax debts, specifically those with the PGFN. For the time being, debt negotiations with the IRS lack regulation.

“If I am a businessman, I keep thinking 'I have a debt with the Attorney's Office, the Federal Revenue and ICMS'. This law grants me the federal installment payment in the Attorney's Office of Finance, I will still be in default both for the debts I have with the Federal Revenue, as well as for the debts I have with the state ”, reports Castelo, from Lopes & Castelo. “What benefit would the entrepreneur have? None. Because what is needed to operate in the market is the certificate of tax compliance, CND, and with this transaction it is not possible to obtain it. There is no attraction that encourages adherence to the tax transaction today ”.

On the other hand, there are lawyers who understand that the law will require a change in taxpayer thinking. "The law must evolve together with good taxpayers, who will mature with these new rules of the game that the Union is bringing to the negotiation", evaluates Tatiana Chiaradia, partner at Candido Martins Advogados. "There will have to be a change in culture, mainly by taxpayers who are badly paying," says Fernanda Lains, partner at Bueno e Castro.

“People were very used to that old Refis model. And the transaction is not that, it involves another type of dialogue with the Attorney General. Together with the taxpayer, a judicial reorganization plan will be considered, but considering tax credits ”, he says. "It is a dialogue on new bases, it is a new culture".

Transaction in litigation

Another novelty of Law 13.988 / 2019 is in article 16, which says that the Ministry of Economy may propose to taxable persons transaction of customs or tax disputes arising from relevant and widespread legal controversy.

“We are waiting for the regulation of the transaction that involves dispute litigation. This is going to be the big news. Here it will involve companies that are discussing theses ”, explains Leonardo Varella Gianetti, lawyer for Rolim, Viotti and Leite Campos.

The rules for discount and negotiation will be the same, with discount limits and classification of each debt. In this case, PGFN will classify as irrecoverable or difficult to recover credits in which there is a greater chance that the taxpayer will have the thesis accepted by the judges.

“What we are predicting is that if the taxpayer has a lawsuit in progress and will be judged by the STF on appeal with general repercussion, why will he give it up? It will be a game theory decision and case by case ”, says Maurício Maioli, from Feijó Lopes Advogados. Gianetti makes a reservation: “The problem is knowing the time of the process and whether you will win. An objective criterion that we have is the jurisprudence. It takes a long time and it is very fearful to say that the thesis is a winner ”.

Penal fines from outside

The tax transaction law does not allow discounts on penal fines. ETCO's executive chairman, Edson Vismona, believes that the law should have made it clearer what would be "penalties of a criminal nature".

“The expression 'of a penal nature' raises doubts about the limits of the fence imposed by the device”, says Vismona. "It would be convenient to clarify that only the fines imposed in the context of criminal proceedings, according to Law No. 8.137, cannot be the object of a transaction, with no restriction in relation to the qualified fines imposed by tax authorities".

Tax attorney Leonardo Andrade is also critical of this point of the law. “This type of measure ignores the practice that there are many tax plans that had the improper application of the fine. In practice, the fines were applied to any case ”, he argues. "I have several clients who had a qualified fine applied in cases where there was no crime and they will not have any benefit because it was understood in the law that there can be no discount for qualified fines", he says. "The transaction had a much smaller scope than it should have."

Article published on 21/08/2020 on the Jota Portal, in the Jota Discute session, which has the support of ETCO.

The tax administrative process is constitutionally based, since the Federal Constitution guarantees all citizens the right to due process and to the adversarial process and to ample defense, both in the judicial and administrative proceedings.

The tax administrative process is constitutionally based, since the Federal Constitution guarantees all citizens the right to due process and to the adversarial process and to ample defense, both in the judicial and administrative proceedings.