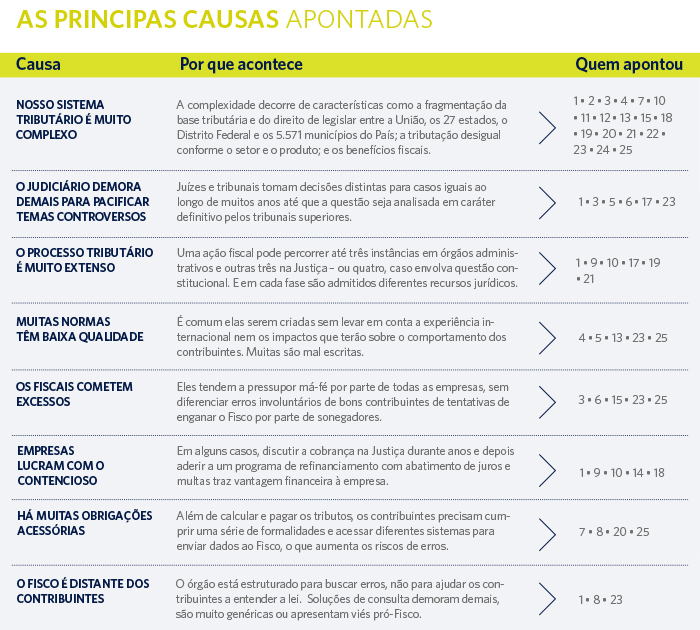

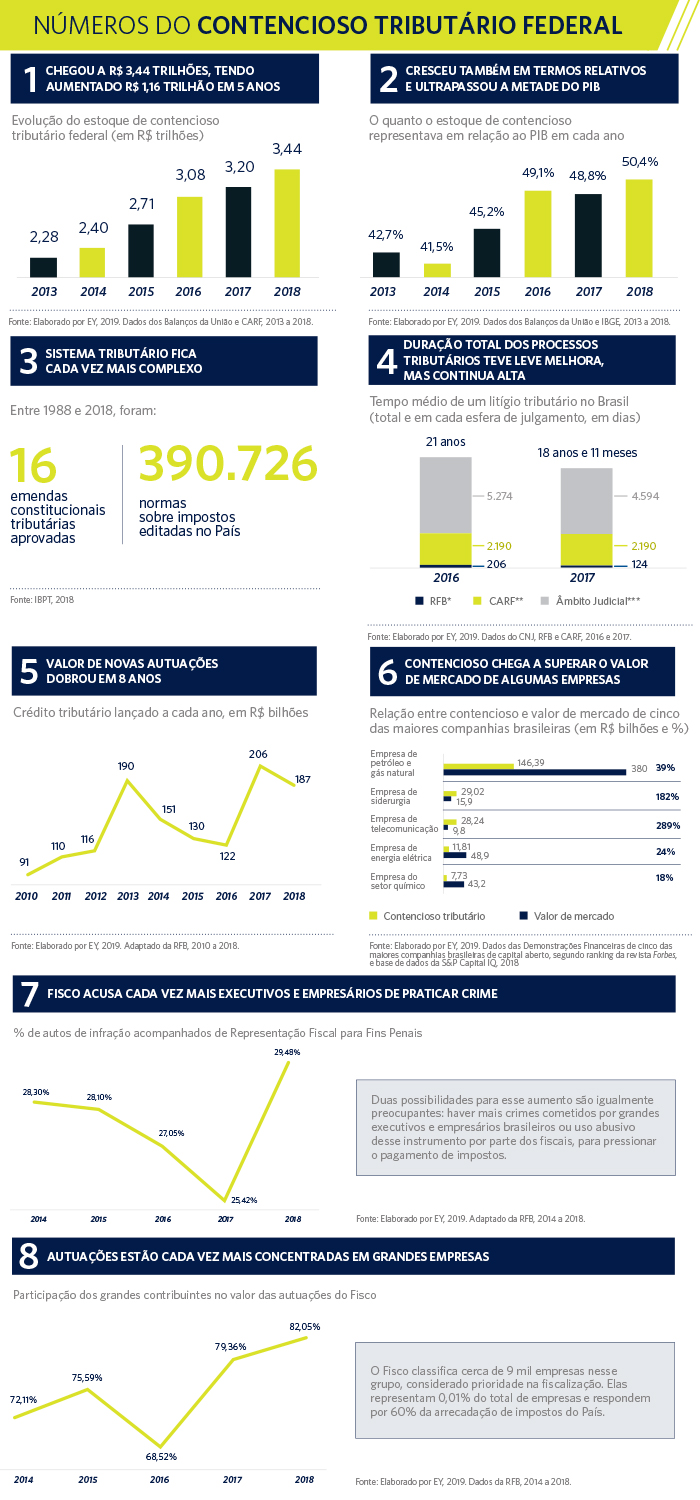

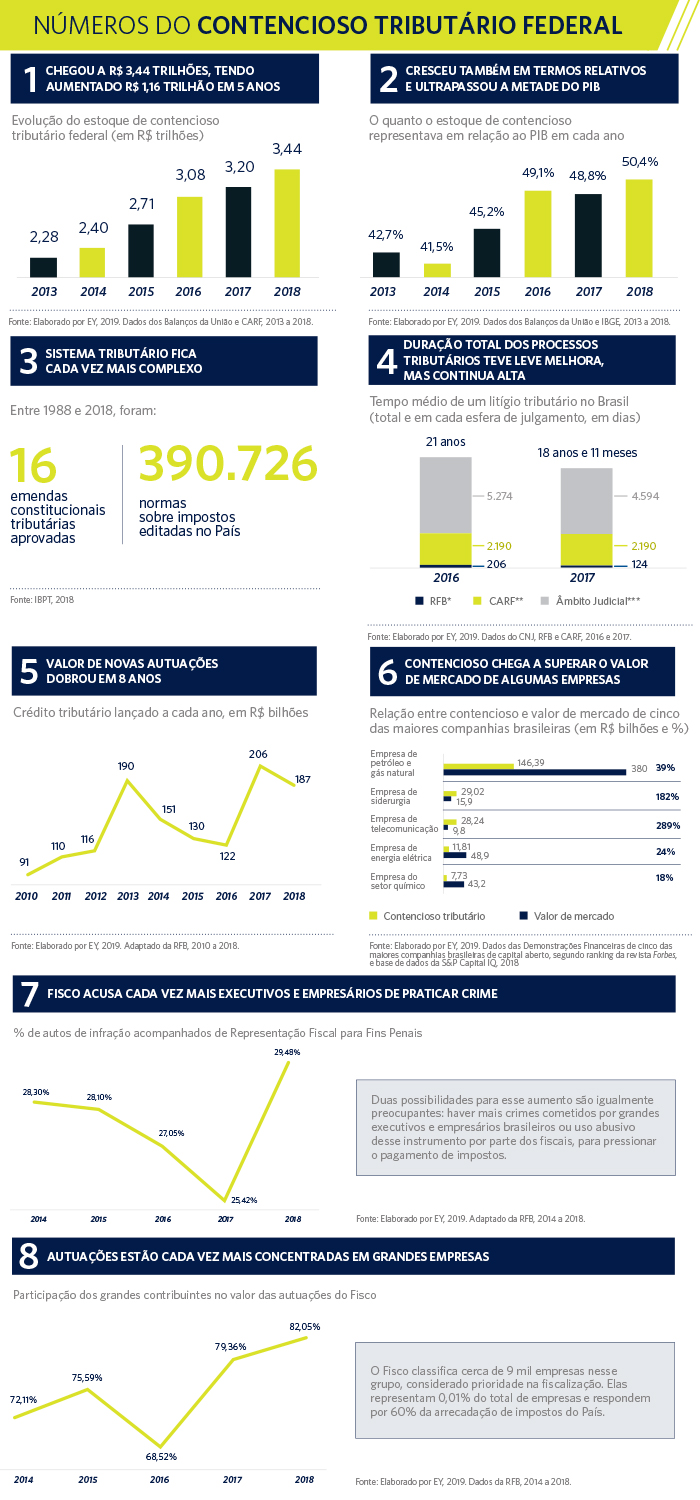

The taxes that the IRS tries to collect from taxpayers, but fails to receive, do not stop growing. They rose from R $ 2,275 trillion in 2013 to R $ 3,440 trillion in 2018. To get an idea of what these values represent - and the pace of the increase -, it is worth comparing them with GDP. During this period, they jumped from the equivalent of 42,7% to 50,4% of all wealth produced in the country in one year.

These figures constitute the so-called federal tax litigation. The fact that they are in the collection process does not necessarily mean that they are due by taxpayers. There are cases in which debts are indisputable, but they accumulate because the State is unable to receive them. The reasons range from the slowness of justice to the insolvency of those who owe. But a good part of this total are charges that taxpayers consider unfair and, therefore, are contesting in the administrative or judicial instances in charge of giving the final say in the dispute.

Whatever the reason, however, the result is that tax litigation of this size - and growing this way - causes a lot of damage to the country. For the State, it means that it is increasingly difficult and costly to collect the taxes necessary to finance the public services, hampering the effectiveness in obtaining results. What could become a school and hospital is spent on lawyers, accountants, judges and other collection costs. For Brazilian companies, the same thing: they spend energy and resources on long processes that have nothing to do with their core activity and that impact on their accounting balance sheets, creating legal uncertainty. When they see these figures, international investors think twice before investing their resources in Brazil.

To further expose this topic to the public debate and contribute to the search for solutions, ETCO hired one of the most important consultancies in the world, EY (Ernst & Young), to carry out a diagnosis of the federal government's tax litigation. The study analyzed public data and shed light on some factors that may be related to the increase in disputed values. EY also mobilized its offices in six other countries to show how they deal with differences between tax authorities and taxpayers (see below).

The data that draws the most attention is the growth of amounts in the collection process in recent years and the fact that they have exceeded half of GDP in 2018. To show the importance of the amounts in dispute for public accounts, the work compares the evolution of litigation with the result of the General Balance Sheet of the Union (BGU), which lists all the assets and liabilities of the federal government.

Soften fiscal adjustment

In recent years, the balance of this account, which corresponds to the Federal Equity of the Union, has worsened greatly due to the government's fiscal crisis. As of 2015, it went into the red and continued to deteriorate until reaching a negative result of R $ 2,42 trillion in 2018. In the same period, the litigation stock went from R $ 2,7 trillion to R $ 3,44 trillions.

It means that if the Union had managed to collect all tax litigation, its Net Worth would have remained in the blue - and the Country would not have been obliged to take measures as harsh as those it adopted to balance its accounts, accentuating the economic crisis.

One of the authors of the work, lawyer Natalie Branco, senior manager of Business Tax Services at EY, makes the reservation that not all of these charges are valid and that a large part of the debtors are companies that have already closed their doors or are unable to pay your debts. "But it gives an idea of how these values are lacking by the government," says Natalie.

The weight for the productive sector also finds evidence in the data. A study by the Getulio Vargas Foundation, released in 2017, had already brought worrying information. The balance sheets of large Brazilian companies registered the existence of R $ 288 billion in tax litigation, more than double the sum of the litigations in the civil (R $ 77 billion) and labor (R $ 39 billion) spheres.

EY's work brought another impressive piece of data. He compared the tax litigation, including social security debts, of five of the twenty largest publicly traded companies in the country, according to the ranking of Forbes magazine, with the market value of these companies, calculated by the consultancy S&P Capital IQ.

In two of them, the tax litigation exceeds the company's value: one in the steel segment, which is worth R $ 15,9 billion and discusses R $ 29 billion in taxes, and one in telecommunications, which is valued at R $ 9,8 billion. billion and records tax litigation 289% higher, of R $ 28,24 billion. In absolute terms, the largest litigation in the sample totals R $ 146,39 billion and concerns a large company in the oil and natural gas sector with a market value of R $ 380 billion.

Why did it increase?

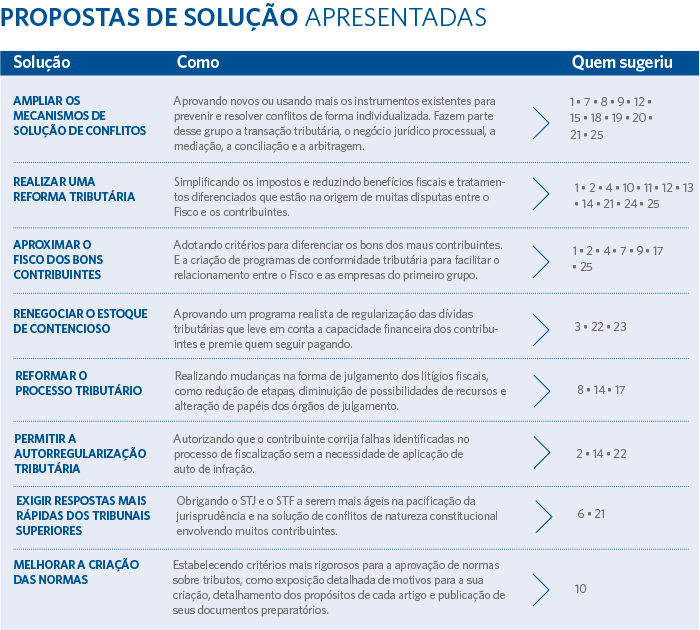

The reasons that explain the high level of tax litigation in Brazil, as well as the measures to mitigate the problem, are addressed in the next pages of this edition by professionals who deal with this problem from different points of view: in the government, in the Judiciary, in the Legislative , in the private sector and in academia. But experts are unanimous in pointing out the complexity of the Brazilian tax system, and its constant changes, as one of the main causes. A survey by the Brazilian Institute of Planning and Taxation (IBPT) showed that, since the promulgation of the Federal Constitution in 1988, until 2018, 16 constitutional amendments were approved and 390.726 tax rules were created in the country.

The EY study sought to elucidate some of the reasons behind the recent growth in the federal litigation stock. Basically, it can occur due to two factors: an extension in the time of the discussion and collection processes or an increase in the tax authorities' assessments.

Tax processes usually take a long time in Brazil. In general, they are initially judged at the administrative level, in two or even three instances; and the taxpayer who loses the dispute can enter the Court, starting from the first instance and can reach the Federal Supreme Court, that is, up to four levels of judgment.

EY raised the average time that a process takes to go all this way based on reports from the Federal Revenue Service, CARF (Administrative Council for Tax Appeals) and CNJ (National Council of Justice). In 2017, it was 18 years and 11 months. The term is extremely long, but slightly shorter than that registered a year earlier: 21 years.

What maintains a clear growth trajectory is the new litigation, generated from the government's inspection processes on taxpayers. When the Taxpayer understands that the taxes that a company has paid are below the amount due, the Tax Authorities assess that taxpayer to collect unpaid tax plus a fine and interest. This procedure is called the posting of tax credits.

The total number of launches fluctuates each year. From 2010 to 2016, it rose for three straight years and then fell for another three. On average, it was R $ 130 billion a year in that period. In 2017, however, this figure jumped and reached R $ 206 billion - an increase of 69% over the previous year. In 2018, it was R $ 187 billion.

Different reasons are given to explain this growth. Another author of the study, lawyer Gidelle Niemann, manager of Business Tax Services at EY, recalls that the Tax Authorities have been implementing several computerized systems to monitor sales and the payment of taxes, requiring their use by taxpayers through so-called accessory obligations. . “The IRS is assessing more and better. It carries out a greater number of infraction notices and is investing heavily in the efficiency of inspection, ”says Gidelle.

Manager Natalie Branco remembers another relevant factor. In 2014, there was an important change in the legislation that regulates how a company can deduct from its Income Tax the goodwill paid on the purchase of another company - that is, the portion that exceeds the amount recorded as Shareholders' Equity in the balance of the acquired party. . The topic involves many companies and high values, and the change generated a large volume of new litigation.

Focus on large contributors

The EY study also analyzed the results of the tax authorities' strategy of concentrating efforts on the inspection of the largest Brazilian companies. This group brings together about 9 thousand large taxpayers, who represent 0,01% of the total companies in the country and account for 60% of tax collection. Between 2014 and 2018, the participation of these companies in the total amount of assessments increased from 72,11% to 82,05%. In 2018, this work brought a collection result of R $ 27,52 billion, the highest ever obtained by the area of monitoring large taxpayers of the Revenue.

The EY study showed, however, a worrying fact regarding the inspections of these companies. In addition to the increase in the number of assessments, the tax auditors have been accusing the representatives of these companies more of committing crimes against the tax order - and not simply incurring an error or diverging from the understanding of the IRS. This occurs when, together with the notice of infraction, the inspector forwards a Tax Office for Penal Purposes against company executives to the Attorney General's Office of the National Treasury. In 2018, they did this in 29,48% of the assessments, against 25,42% a year earlier.

EY's work did not seek to analyze the causes of this increase, but, among the various possibilities, two are disturbing: that there could be an intention to apply this instrument to force the payment of taxes or that the greatest entrepreneurs and executives in the Country started to commit more tax illegalities in recent years. Whatever the real reason, it represents bad news for a country that urgently needs to improve the quality of its business environment.

GOOD EXAMPLES FROM OTHER COUNTRIES

In the study carried out for ETCO, EY mobilized its offices in six other countries to show how they resolve conflicts between the tax authorities and taxpayers and seek inspiration for the Brazilian problem. The chosen nations are in different stages of development, but all of them appear in a better position than Brazil in the ranking of the Global Competitiveness Report of the World Economic Forum 2019: United States (2nd place), Germany (7th), Australia (16th) ), Portugal (34), Mexico (48) and India (58). Brazil appears in 71st among the 141 countries evaluated.

They were also chosen for presenting different models of conflict solutions or for their direct influence (Portugal) or economic similarities with Brazil (Mexico). India was included because it also had a high level of litigation between tax authorities and taxpayers and for not tackling the problem of legal uncertainty and litigation in the tax reform it carried out in 2017, focused on replacing a state Value Added Tax with a national tribute. Since then, the country has fallen 18 positions in the competitiveness ranking of the World Economic Forum.

The following is the main lesson regarding the litigation that the EY study found in each of these countries:

1 Mexico:

It allows negotiation between the taxpayer and the Tax Authorities during the inspection phase, authorizing the conclusion of a conclusive agreement between the parties.

2 U.S:

It allows for an agreement before or after the issuance of the notice of infraction, with rapid mediation and independent dispute arbitration processes.

3. Portugal:

It provides the taxpayer with an arbitration system immediately after the issuance of the tax assessment notice.

4. Germany:

It favors the dialogue between the Tax Authorities and the taxpayer during the inspection, enabling informal agreements that prevent the generation of litigation.

5. India:

It undertook a tax reform in 2017 that did not place legal security as a central theme. Judicialization remains high, with cases that can last 31 years.

6. Australia:

It offers ample space for defense and negotiation between the parties in the administrative appeal phase, including mediation, case assessment, conciliation, conference and neutral assessment.