ETCO and Ibre / FGV study follows the informal market in the country

Research started in 2007 and brings the historical evolution of the underground economy since 2003

ETCO, in conjunction with the Brazilian Institute of Economics of the Getúlio Vargas Foundation (Ibre / FGV), has since 2007 published the Underground Economy Index, a study that estimates the values of activities deliberately not declared to public authorities.

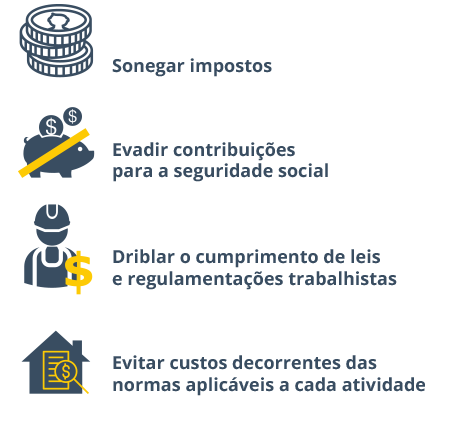

The underground economy is the production of goods and services not reported to the government, deliberately, to:

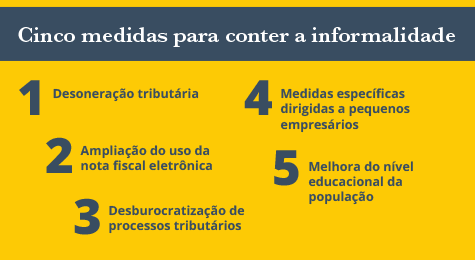

The partnership between ETCO and Ibre / FGV to monitor the underground economy provides the country with the main indicator of the evolution of informal activities. Knowing the size of the problem is essential to combat it. In Brazil, informality is estimated by high tax burden, corruption and unemployment. the result is known: evasion, smuggling and piracy, which generate serious competitive imbalances.