Brazil stops reducing informality

After 12 years of falling, the Underground Economy Index stops due to the recession and the increase in taxes

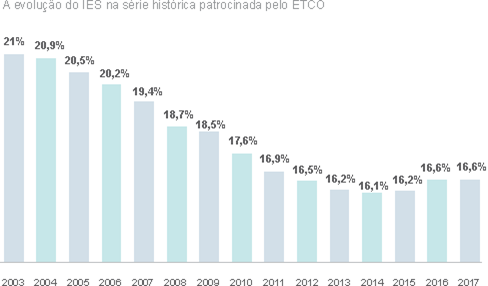

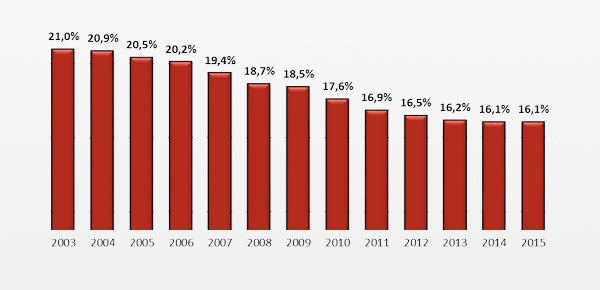

The ETCO-Brazilian Institute of Ethics in Competition and the Brazilian Institute of Economics of the Getulio Vargas Foundation (IBRE / FGV) released on November 30 the Subterranean Economy Index (IES) for 2015. According to the survey, the informal market will move R $ 932,3 billion this year. The value represents 16,1% of the Gross Domestic Product (GDP), the same percentage verified in 2014. The IES measures the size of activities not declared to the public power, such as smuggling, piracy, tax evasion and informal employment.

This is the first time, in 12 years of research, that the informal economy has not retracted in the country. During this period, the index decreased by 4,9 percentage points, the result of a set of factors, such as the formalization of employment and the growth of the economy.

Curve change

According to the study's authors, stability in 2015 may mean the start of the change in the index curve. The current economic scenario, which includes economic difficulties, rising unemployment and increasing the tax burden, should increase the participation of the informal economy in the coming years.

Economist Samuel Pessôa, a researcher at IBRE / FGV, explains the upward trend: “The crisis started in the second quarter of 2014 and unemployment only grew strongly this year. It currently stands at 8,9% and is expected to reach 11% next year. It is practically inevitable that part of this workforce will migrate to the informal economy ”. According to Pessôa, as long as the economic situation does not undergo structural adjustments, the tendency is for the index not to fall again.

The ETCO president recalls that the solution that governments have been adopting to face the fiscal crisis, based heavily on tax hikes, ends up further increasing the appeal of the underground economy. “The complexity of the tax burden is another factor that leads to informality”, says Evandro Guimarães.

In highly taxed segments, such as cigarettes, for example, today almost 40% of sales are the result of smuggling. Even so, state governments, like the one in São Paulo, are increasing the tax burden even more.

The partnership between ETCO and IBRE / FGV to monitor the underground economy provides the country with the main indicator of the evolution of informal activities. “Knowing the problem is the first step in order to face it”, explains Evandro Guimarães. According to him, it is important that there are more government initiatives to contain the problem. "We need measures capable of simplifying the tax system, in addition to structural changes in society so that this economic model does not harm those who act within the law, following all the rules and paying all taxes," he says.

How the index is calculated

The IES is defined based on a set of static data that assess informality in employment and the relationship between the size of the economy and the use of cash (underground activities tend to use less bank transfers). One of the main sources of information is the National Household Sample Survey (PNAD).