Ano: 2020

Historical index

Informality brings direct damage to society, creates an environment of transgression, stimulates opportunistic economic behavior, with a drop in the quality of investment and a reduction in the growth potential of the Brazilian economy.

In 2022, the Underground Economy moved BRL 1,7 trillion, returning to the pre-pandemic pattern.

How it is calculated

The size of the underground economy is estimated from two indicators:

The Shadow Economy Index is calculated by averaging two important indicators of the economy. Monetary method Raising the currency due to the tax burden and informal work. Informal work Percentage of workers without a formal contract and income from informal work.

Informal activity tries to remain unobserved by the authorities and, consequently, has a higher demand for money than formal activities, which use more banking instruments for their transactions. Thus, the increase in informal activity will raise the demand for money through two channels:

-

- Increase in the proportion of workers without a license.

- Higher taxation.

The hypothesis is that the increase in taxation induces an increase in the underground economy, which also generates an increase in the demand for currency

Based on the PNAD, the average is calculated between the percentage of informal workers and the percentage of income from work that is informal.

The level of the underground economy is the average between the two methods: monetary method and informality in the labor market.

The cost of smuggling

The study The Cost of Smuggling, carried out by the Institute of Economic and Social Development of Borders (Idesf), in partnership with the Gaúcha Public Opinion and Statistics Company (Egope), aims to analyze the main impacts of smuggling on Brazilian society, focusing on the 10 most popular products. smuggled from Paraguay to Brazil.

See the study below:

THE-COST-OF-CONTRABATINGDamages caused

Brazil lost R $ 146,3 billion in 2017 to piracy. The value is estimated by the National Forum Against Piracy and Illegality (FNCP), which coordinates together with ETCO the Movement in Defense of the Brazilian Legal Market.

The value is the estimate of the losses of companies and the government with tax evasion of pirated and smuggled products.

In 2017, companies stopped billing R $ 100,2 billion. The most affected sector was clothing (R $ 35,6 billion), followed by cigarettes (R $ 12,3 billion), glasses (R $ 7,7 billion) and pay TV (R $ 4,8 billion) bi). The amount represents the lost market for pirated products. These illegal products fail to pay an average tax rate of 46%.

The main findings of the study carried out by EY in Brazil and abroad

The Brazilian Tax Litigation Challenges study was carried out by EY. The consultancy company gathered and analyzed data from several federal government and justice agencies, in addition to research on the topic produced by other institutions. It also involved EY teams in six countries chosen to analyze litigation solution models: Germany, Australia, United States, India, Mexico and Portugal.

The work was carried out by the managers Nátalie Branco and Gidelle Niemann, under the coordination of the EY partner responsible for the tax area, Érica Perin. Following are six highlights of the study:

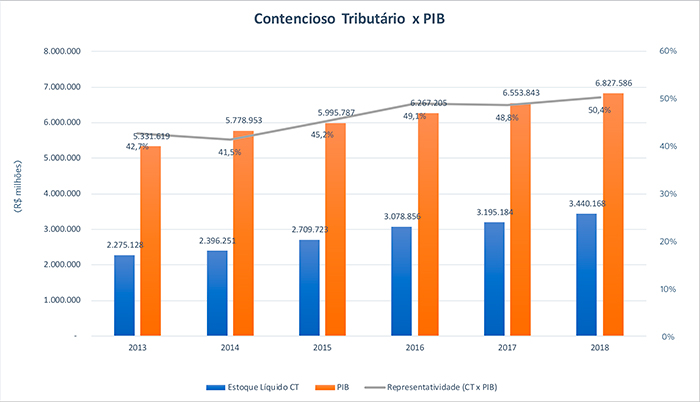

1. Litigation / GDP ratio keeps growing

The Union's contentious tax credit stock, comprising tax credit from the Federal Revenue of Brazil (RFB) and the Attorney General's Office of the National Treasury (PGFN), has been growing both in absolute terms and in relation to GDP. In 2018, according to data from the General Balance of the Union, it reached R $ 3,4 trillion, exceeding half of the GDP (50,5%).

2. Tax lawsuits last almost two decades

The completion of a tax litigation process in Brazil takes an average of 18 years and 11 months, in the sum of the administrative and judicial stages. According to Érica, EY calculated this time based on data from the 2017 Annual Activity Report of the RFB; a report on judgments by the Administrative Council for Tax Appeals (CARF), made available by the agency in 2015 on the occasion of Operation Zelotes; and the Justice in Numbers Report of 2017 and 2018 of the National Council of Justice (CNJ).

3. Several factors induce litigation

In the study, EY cites several factors that contribute to the high degree of litigation in the Brazilian tax system. The list includes: the complexity of the legislation; the amount of ancillary obligations; the high tax burden; and aspects related to penalties, tax debt correction and tax regularization programs that end up making litigation an alternative for business financing.

To illustrate the degree of complexity, the EY partner cited a survey by the Brazilian Institute of Planning and Taxation (IBPT) on the number of changes in tax rules from 1988 to 2018. “In the period, 16 tax constitutional amendments were approved and edited 390.726 tax rules, ”said Érica.

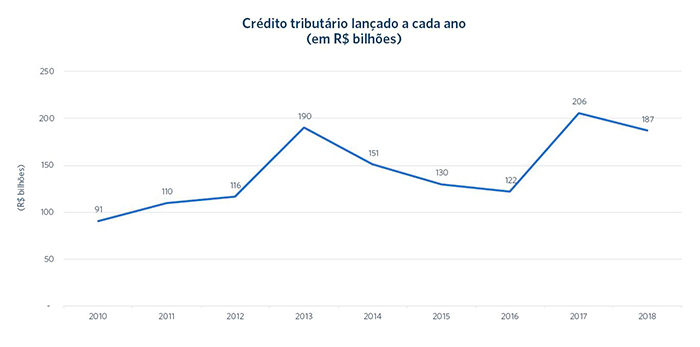

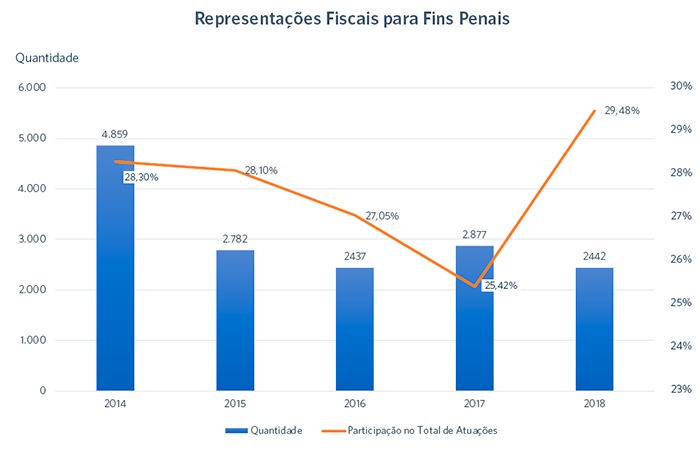

4. Increase in tax assessments and representations for criminal purposes

The study showed a worsening of the situation in recent years. The annual value of credits launched by the Federal Revenue in its inspection procedures increased 68% in 2017, compared to the previous year.

There was also an increase in the percentage of assessments that generated tax representations for criminal purposes, with the application of an aggravated fine (double), which went from 25,42% in 2017 to 29,48% in 2018.

According to the partner of EY, these numbers coincide with the expansion of ancillary obligations and other methods of monitoring large taxpayers and with the entry into force of Law 13.464 / 2017, which instituted productivity bonuses to inspectors linked to a fund. which varies according to the collection.

The study cites a survey carried out by the Brazilian Association of Jurimetry in 2014 on the results of judgments of fines aggravated in the administrative and judicial spheres. The decisions gave taxpayers more reason (fines dropped in 45% of cases) than the tax authorities (maintained at 36%), with partial results in other cases.

5. Greater focus on large contributors

The survey also showed that, in recent years, the IRS has increasingly focused on oversight of large taxpayers, who represented 68,62% of the assessments in 2016 and increased to 82,05% in 2018.

Because of this strategy, litigation is becoming an increasing problem for large companies. EY analyzed the balance sheets of five of the twenty Brazilian companies listed in a survey by Forbes magazine about the 2 largest publicly traded companies in the world in 2019. In some cases, the litigation is greater than the company's market value.

Recalling that in order to discuss tax credits in court, companies are obliged to offer guarantees, usually contracted with banks, EY's partner drew attention to a serious problem that may occur in the near future if the country does not reverse the growth curve of the litigation. "We are already at a very high level of guarantees," warned Érica. "If it continues to grow, we could have a serious crisis in terms of the banks not being able to give these guarantees anymore".

6. Solutions that work in other countries

The analysis of conflict resolution models from six other countries sought to identify mechanisms that could be applied to reduce Brazilian tax litigation. The study chose nations better positioned than Brazil (80th place) in the ranking of the 2017/2018 Global Competitiveness Report of the World Economic Forum: United States (2nd), Germany (5th), Australia (21st), India (40th) , Portugal (42nd) and Mexico (51st). The selection also sought to bring examples of different legal systems (civil law and common law) and of nations with direct influence (Portugal) or economic similarities with Brazil (Mexico and India).

The following is a highlight from each country:

United States: It allows an agreement before or after the issuance of the infraction notice, with quick mediation and arbitration processes independent of conflicts.

Portugal: It provides the taxpayer with an arbitration system immediately after the issuance of the tax assessment notice.

Germany: Favors the dialogue between the tax authorities and the taxpayer during the inspection, enabling informal agreements that prevent the generation of litigation.

Mexico: It allows negotiation between the taxpayer and the tax authorities during the inspection phase, authorizing the conclusion of a conclusive agreement.

India: It has alternative mechanisms for resolving conflicts in complex cases, but judicialization, which was not the target of the tax reform carried out in 2017, remains high. In total, tax proceedings can last up to 31 years.

Australia: It offers ample space for defense and negotiation between the taxpayer and the tax authorities in the administrative appeal phase, including mediation, case assessment, conciliation, conference and neutral assessment.

Tax lawyer Roberto Quiroga talks about the study's findings

Tax lawyer Roberto Quiroga, a professor at the law school of the Getúlio Vargas Foundation of São Paulo (FGV Direito SP), participated in a debate after the presentation of the Brazilian Tax Litigation Challenges study. He praised the ETCO initiative and the work of EY, considering them a milestone in the search for solutions to the problem of tax litigation. "We had some surveys on litigation, but we did not have an official compilation, made by one of the four main audit companies in the world, which was covered and will be released by an institution with the relevance of ETCO," he said.

Quiroga drew attention to the magnitude of the federal litigation stock. “We are talking about R $ 3,4 trillion, more than 50% of the Brazilian GDP, which reveals a very insecure data. The number shows that something is wrong ”. And he emphasized the generation of new litigation. “As the study showed, over the past five years, the tax authorities have assessed about R $ 160 billion, R $ 170 billion per year. This represents between 10% and 12% of the collection that goes into litigation each year. ”

Another highlight of the research commented on by Quiroga was the concentration of inspection on large contributors. “EY brought a very important number: close to 8 thousand companies represent 60% of the tax collection and practically 80% of the tax assessments. So, actually, who are we filing? We are assessing the goose that lays the golden eggs. The companies that generate the highest revenue. ”

Another important data brought by the study, according to the tax expert, is the increase in the percentage of assessments that are generating tax representation for criminal purposes, an instrument that takes the discussion to the criminal sphere. "We are seeing a clear advance in the criminalization of tax conduct, in which almost 30% of the infraction notices are with criminal representation," he said.

Quiroga spoke about the measures he considers necessary to reduce litigation. He defended changes in the inspection procedure to standardize the inspectors' understanding, preventing functional independence from being used to allow each one to have their own tax thesis. “It is not that they should not have functional independence. But there should be a hierarchy in the sense of the assessment, ”he explained. “Today, what happens? Inspection arrives and the inspector, based on his functional independence, checks his head, the way he wants, without guidance from the IRS dome. ”

The professor at FGV Direito SP also defended the adoption of measures to prevent and combat the excesses that have been practiced by many inspectors. In his opinion, inspectors should be held responsible for errors that cause taxpayers losses. "The inspectors often make bad mistakes and we do not have the counterpart of charging for this error that he made", he explained. “We need to evaluate how to improve enforcement so that it is not a process of anger, a process against each other, but something like the EY study showed that it happens in the United States, where the taxpayer can talk to the supervisor about mistakes. "

Quiroga also spoke about the need for the Brazilian State, which already classifies a large part of the litigation as irrecoverable, to officially recognize these losses, a write-off. “There is no alternative. It is necessary to arrive and say the following: we will not recover this value. Are we going to do a write-off? ”. And focus on what can be charged.

"A study like this is a public good"

The contributions of tax law professor Breno Vasconcelos, from FGV Direito SP, in the debate after the presentation of the Brazilian Tax Litigation Challenges study shed even more light on the topic. He is one of the authors of another important research on the subject, which collected federal, state and municipal data and compared Brazilian litigation with that of OECD countries and Latin America.

"The presentation of a study like this is a public good", he praised. "We are talking about a service that ETCO, EY and ETCO associates are providing to society". Breno said that his research “hits almost pennies with what EY achieved in relation to federal litigation”, of an amount equivalent to just over half of the Brazilian GDP. "But the situation is even worse," he said. According to him, adding also the litigation of the states and few municipalities whose data are available, today it reaches a figure corresponding to 73% of GDP.

The Brazilian situation, according to Breno, is completely different from what is observed elsewhere. “We usually hear a lot from representatives of the tax administration that the Brazilian taxpayer is bad. But when I ask companies that work here and abroad about litigation in other countries, the difference is clear ”, said Breno. “They say: ´in Spain, I have a case, while in Brazil there are 3 tax cases´ The data is really impacting.”

The study in which he participated made a comparison of the federal tax litigation under discussion in the administrative sphere in Brazil with that of 14 other countries analyzed by the OECD in research with data from 2013. Here, this portion of the litigation represented 13,9% of GDP in that year (and it would get even worse afterwards, reaching 16,4% in 2018). In nine OECD nations analyzed, the median for the same data was 0,28%. In five countries in Latin America, 0,19%.

How to solve the problem? According to Breno, the solution depends on several initiatives. A fundamental step, in his opinion, is “the tax administration to know how to differentiate who is the good taxpayer and who is the bad taxpayer”. And based on this distinction, create conflict resolution measures aimed specifically at good taxpayers, such as advanced tax ruling, fast tracks and a service channel that is easily accessible in person or by phone. It is also necessary to reduce the complexity and excess of changes in the tax system, which has gained 390 thousand new rules in the last three decades.

The tax attorney also made a suggestion that, he warned, carries a certain amount of provocation. Demonstrating that the two instances of judgment in the administrative process have taken very different decisions - the first, represented by the Federal Revenue Judgment Offices (DRJs), largely favoring the tax authorities, and the second, the Administrative Council for Tax Appeals (CARF), giving taxpayers more reason -, asked if it would not be better to end the trials in the DRJs and employ their technical staff in actions to prevent litigation. For example, designing consultation solutions, negotiating agreements or mediating conflicts between tax officials and taxpayers.

In his words:

“From DRJ to CARF, approximately 6% of official resources go up. It is a fact that [shows that] the DRJ is canceling only 6% of the infraction notices submitted to it in an amount greater than R $ 2,5 million, therefore an appeal to CARF. That is, the legality control of the DRJ is 6% of the total inventory. What is CARF's control? Official data: 52,4% of CARF cases are judged in favor of taxpayers. Looking at this data, we begin to realize that something is wrong. Is the DRJ fulfilling its legality control role? We understood that it was not. ”

“Our provocation is as follows. I am not talking about people, but about the entity: what is the relevance of a DRJ today for purposes of controlling the legality of tax credit? It is small: 6%. So, what to do with DRJ? They are groups of auditors, a collegiate with highly prepared people who are not doing something correctly. And there are two data: the DRJ judges according to an infralegal normative reference, it is obliged to follow the understanding of the Federal Revenue Secretary. The DRJ's normative judgment system is more restricted than the CARF normative system, which is the legal system, are treated etc. ”

“In fact, this is a provocation: the impression we have is that today we already have in Brazil only one administrative body, which is CARF. The DRJ is another more restricted administrative body, so in fact the broad legal administrative body is one, CARF. In other words: DRJ is already redundant. ”

“[So], bring the DRJ to the pre-litigation. It brings this mass of excellent professionals to answer consultation solutions. Bring the DRJs to serve as the collegiate that will do the pre-auto analysis. Some countries, when we are going to study comparative law - Denmark, Norway, the United Kingdom -, have a pre-report, it is a draft of the tax report in which the supervisor submits it to a collegiate body and there you can make a kind of agreement, mediation, transaction, before this collegiate ”.